[ad_1]

![]()

Throughout our Pillars of Retirement sequence we have acquired a lot of suggestions and commentary on the primary of the pillars – The Age Pension. A lot of our members discover coping with Centrelink extraordinarily irritating and lots of others discover the system extraordinarily unfair. We regularly obtain feedback reminiscent of:

- Why doesn’t every member in a couple get the identical as a single? In spite of everything there are two folks to feed, fabric and medical bills aren’t shared?

- Why don’t single folks get extra? In spite of everything lease, electrical energy, charges and many others are simply as costly for a single as a couple?

- Renters are a lot worse off than owners, so shouldn’t they get extra Age Pension?

- Isn’t the house exempt so why do renters get a further allowance?

- Why am I punished for incomes additional revenue?

- Shouldn’t I be assessed on what I truly earn, not what I’m deemed to earn?

Everybody has their very own perspective and there isn’t a single proper or improper reply. What the feedback do have in widespread is frustration on the system, significantly across the means testing guidelines. It’s an absolute nightmare for some folks to navigate.

It could shock you to be taught that the means testing in our system – the property and revenue exams – are uncommon in most nations. Some nations have a lot less complicated techniques providing what is commonly often called a Universal Age Pension. Basically everybody that meets the age and residency necessities will get a pension. We have written about this earlier than and lots of of our members have prompt this is able to be a significantly better system. So why don’t we do it in Australia?

A little bit of historical past

The Age Pension in Australia was first legislated in 1908 and got here into operation in July 1909 for males and November 1910 for ladies. Initially it was paid to males at age 65 and girls at age 60. The Australian pension system was uncommon in that it didn’t depend on contributions and in addition that it was means examined. These cornerstone ideas are nonetheless in place.

Different fashions world wide embrace:

- Denmark the place everybody will get half the age pension and the second half is means examined

- The U.Okay. the place everybody that has at the least 10 years on their Nationwide Insurance coverage report qualifies for at the least the minimal pension and it will increase based mostly on how lengthy you have been contributing.

- The united statesA the place your contributions to the Social Safety system decide how a lot you get.

Not like in Australia the place the Age Pension is means examined, some nations such because the Netherlands and New Zealand, pay an age pension to everybody that meets their residency necessities. Everybody will get the identical quantity no matter how rich you might be – a universal Age Pension.

Why don’t we try this in Australia?

As we talked about In Australia eligibility for the Age Pension is means examined. The rationale for that is two-fold. Firstly it helps make sure that Authorities entitlements go to those that want them most and secondly by placing a restrict on the variety of folks which are eligible, the Age Pension turns into extra inexpensive for the Authorities.

Why pay an Age Pension to everybody?

Paying an Age Pension to everybody won’t at first appear very equitable. In spite of everything, shouldn’t those who want it most be prioritised? Isn’t the pension there to assist folks that may’t fund their very own retirement? And wouldn’t providing an Age Pension to everybody imply a ballooning price to authorities (taxpayers) or would it not be funded by decreasing the general stage of pensions?

There are some various arguments in favour of a universal Age Pension although. Listed here are simply a few:

- The present system is sophisticated and expensive to manage so the Authorities might save a lot of cash.

- It will create extra incentive for folks to save lots of for their very own retirement. At current some individuals are reluctant to save lots of as they concern it is going to scale back their pension entitlements. A lot of our members are pissed off by this.

- It might additionally present stronger incentives for folks to downsize the household house in the event that they had been ready to take action with out impacting their Age Pension. Even with the provisions to permit extra of the proceeds to enter tremendous there might nonetheless be pension impacts.

What do you assume?

It’s a difficulty with robust arguments on each side and there will likely be a lot of opinions. .

And if you need to make a remark or add your perspective you are able to do under.

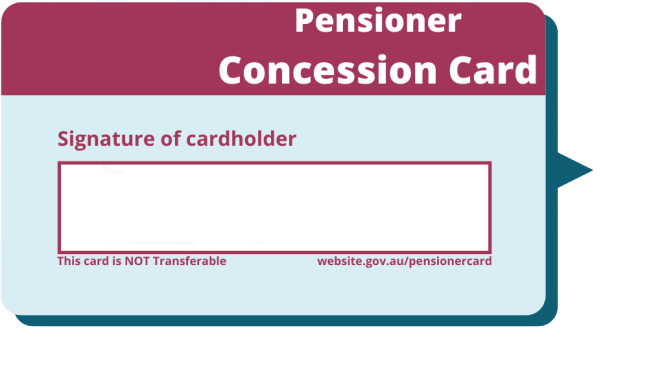

And eventually, whereas not everybody can get the Age Pension on this nation, these that may don’t need to miss out.

You possibly can test if you’re eligible under.

Supply hyperlink

LBA Writer

Add Comment